Build credit by paying rent on time.

Your on-time rent payments are reported to credit bureaus—so you can build credit faster and track your progress with confidence.

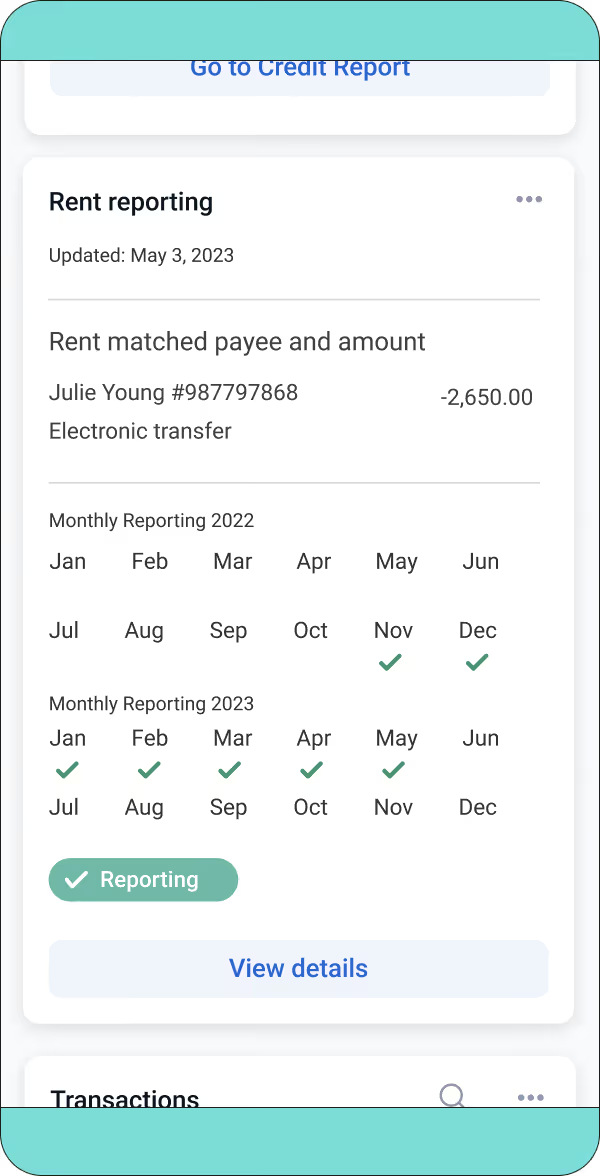

Rent reporting made easy

We report only positive, on-time rent payments, helping you build positive credit history without the risk of negative impacts.

How It Works

Start building credit with your rent payment in just 3 easy steps

Create a free account

Create your ZeGid account by providing basic information

Get verified

Complete rental verification process. No credit pull is required.

Build credit

We'll report your positive rental payments up to 24 months of rental history and your future payments

Frequently Asked Questions

Rent reporting is the process of reporting a renter's monthly rental payments to the credit bureaus. This allows renters to build credit history and potentially improve their credit scores.

We report one batch of rent payment data per month to the credit bureaus.

The time it takes to see results from rent reporting can vary, but many renters can see a positive impact on their credit scores within a few months of consistent, on-time rent payments being reported.

No, previously reported rent payments will not be removed from the renter's credit report. Once rent payments are reported to the credit bureaus, they remain on the credit report and continue to contribute to the renter’s credit history, even if the renter moves or stops reporting future payments.

Yes - we can report rent payments up to 24 months in the past, as long as the payments are for the same lease and property.

Our partners use industry-standard security measures to protect renter data. They also provide dispute resolution support to ensure accurate credit reporting.

Ready to get started?

Join thousands using ZeGid to build credit, grow wealth, and take control of their finances.