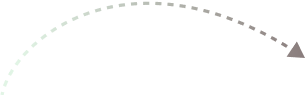

Credit Manager

Credit motoring made easy

View credit score and receive a detailed credit report from all three major credit bureaus.

VIEW MY REPORTBuild credit, build wealth, and take control of your finances — simply, securely, in one place.

Powered by trusted partners to help you manage money smarter, grow wealth, and access financial products with clarity and confidence.

Payment performance is reported to:

Your on-time rent payments are reported to all three major credit bureaus—so you can build credit faster and track your progress with confidence.

View credit score and receive a detailed credit report from all three major credit bureaus.

VIEW MY REPORT

Build real credit without taking on debt. You make affordable monthly payments, we report them to the major credit bureaus, and your money is set aside for you to save.

Build wealth with fractional, globally diversified stocks, ETF portfolios, high-yield cash, self-directed investing, and more.

Build wealth with fractional, globally diversified stocks, ETF portfolios, high-yield cash, self-directed investing, and more.

GET STARTED

ZeGid makes managing your finances simple and intuitive. Follow these easy steps to get started

Find all debt accounts in seconds, receive automated guidance, and act on personalized strategies — all in one place.

Stay on top of recurrent bills. Save time and money by canceling services you no longer use.

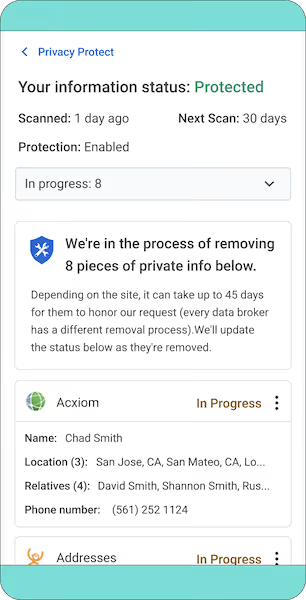

SEE HOW IT WORKSUp to 98% of consumers and employees have their information exposed on Data Broker and People Search sites—putting their privacy and security at risk.1

Government-backed loans designed to make long-term financing easier to access.

APPLY NOWApplying is free and won't impact your credit1

But don't take our word for it, see what other people are saying! 93% of active users feel their overall financial health improved.*

ZeGid gave me a clear picture of my credit and finances in one place. The credit monitoring and insights helped me understand what was hurting my score and what to fix — without feeling overwhelmed.

I love how ZeGid combines credit tools, financial education, and investment insights into one simple app. It’s helped me feel more confident about managing my money long-term.

ZeGid makes financial planning feel simple. From tracking my credit progress to exploring investment options, everything is easy to understand and well-organized.

What I appreciate most about ZeGid is the clarity and transparency. No confusing jargon — just practical tools to build credit, manage finances, and make smarter money decisions.

ZeGid is an all-in-one financial platform that helps you build credit, grow wealth, and manage your finances. We bring together credit monitoring, identity protection, investment tools, loan access, and financial insights in one easy-to-use app.

No. Checking your credit through ZeGid does not impact your credit score. Some optional credit-building products may report positive activity to credit bureaus, which can help improve your score over time.

Yes. ZeGid gives you a unified dashboard to track your credit score, credit report changes, subscriptions, spending insights, investments, and loan options — all in one place.

Yes. ZeGid uses bank-grade encryption, secure data handling, and industry best practices to protect your personal and financial information. Your data is never shared without your permission.

ZeGid gives you access to credit monitoring, identity protection, credit-building tools, investment opportunities, personal and business loan offers, and financial education — tailored to your financial profile.

ZeGid offers free access to core features, with optional premium services available. Any paid features are clearly disclosed upfront — no hidden fees.

Join thousands using ZeGid to build credit, grow wealth, and take control of their finances.